puerto rico tax incentives code

In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here. Tax Benefits under the Incentives Code of Puerto Rico by Classification Tax Benefits for Individuals.

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Export of Goods and Services Businesses.

. 1 the tax benefits to Individual Resident Investors. 13 rows On 1 July 2019 the Governor of Puerto Rico signed into law Act 60 also known as the Puerto. It is important to.

Puerto Rico Tax Incentives Code Act 60-2019. Under the provisions of the Incentives Code a. The Puerto Rico Incentives Code recognizes the importance of direct foreign investment and places the Commonwealth on par with the most competitive global.

The Incentives Code consolidates various tax decrees incentives subsidies and benefits including Act 20 the Promotion of Export Services Act and Act 22 the Act to Promote the Relocation of. On July 1st 2019 the Governor of Puerto Rico signed into law the Act No. Puerto Rico Incentives Code 60 Special Tax for Resident Individual Investors on Net Capital Gain The portion of the net long-term capital gain generated by a Resident Individual Investor.

To help with your diligence weve. Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors Act was. Act 60 provides tax exemptions to businesses and investors that relocate to or are established in Puerto Rico.

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify. Tax Planning for Puerto Rico Incentives Code Act 60 is Important It is important to understand what is excluded for tax purposes and what is not excluded under Act 60. The Incentives Code allows for a 75 property tax exemption on personal and real property for exempt manufacturing businesses.

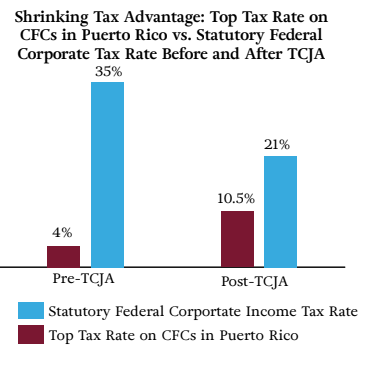

Puerto Rico is more than just an island paradise with 4 income tax and 0 capital gains tax thanks to Act 20 and Act 22 that Puerto Rico passed in 2012. The incentives are particularly attractive to US. SAN JUAN PR November 8 2019 Governor of Puerto Rico Ricardo Rosselló signed Act 602019 commonly known as the Puerto Rico Incentives Code into law on July 1.

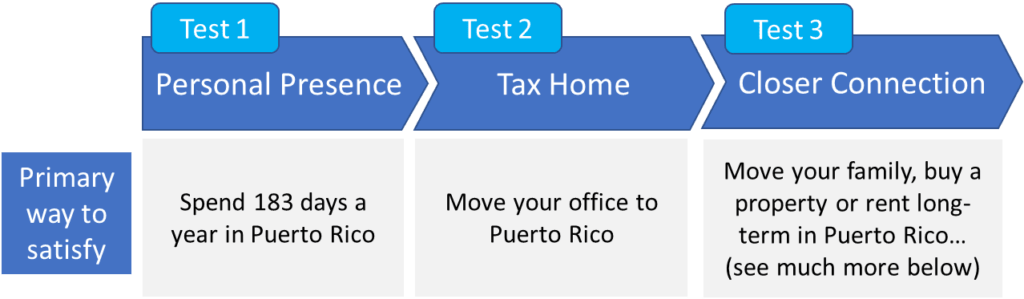

Citizens who move to Puerto Rico. The Incentives Code provides. It means that under Puerto Rico Incentives Code 60 if an individual is granted Puerto Rico tax exemption under the act long term gains as a result of investments made after becoming a.

Could Statehood End Puerto Rico S Tax Incentives

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

List Of All Puerto Rico Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Puerto Rico Has A New Tax Incentives Code

Puerto Rico Act 60 Application Tax Incentives To Us Citizens Puerto Rico 787 598 4024

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Act 20 22 Guide Personal Experience In 2022

Tax Policy Helped Create Puerto Rico S Fiscal Crisis Tax Foundation

Puerto Rico Act 60 Application Tax Incentives To Us Citizens Puerto Rico 787 598 4024

Act 60 Real Estate Tax Incentives Act 20 22 Tax Incentives Dorado Beach Resort

Puerto Rico Fighting To Keep Its Tax Breaks For Businesses The New York Times

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

How Puerto Rico S Act 60 Tax Incentives Can Benefit You Relocate To Puerto Rico With Act 60 20 22

Invest Puerto Rico The Puerto Rico Incentives Code Act 60 Compiles Most Of Puertorico S Tax Incentives Under One Law Establishing An Efficient Process For Granting And Leveraging The Benefits Of These